The companies that achieved the highest service score overall are.

- Woolworths Food – Food Retail Stores

- Burger King – Fast Food Outlets

- Woolworths Clothing – Clothing Retail

- BMW – Automotive

- Clicks – Pharmacy Pharmacies

- Audi – Automotive

- Mercedes-Benz – Automotive

- Beares – Furniture Shops

- Checkers – Food Retail Stores

- Foschini – Clothing Retail

"These top 10 winners all display service excellence and are able to meet growing expectations from customers who are faced with a greater choice and display diminishing loyalty," says Sarina de Beer, director: client experience at Ask Afrika.

"This year, there was a strong dominance from the retail and automotive industries in the top 10 winners. It is interesting that the telecommunications and financial services industries are no longer winning as they used to a few years ago," de Beer adds.

"The top three industries in the 2018/19 Ask Afrika Orange Index in rank order were the automotive, clothing retail and food retail industries," she says.

The Ask Afrika Orange Index benchmark has an 18-year history and aims to measure best practice in service not only within, but across, different industries. In 2018, 167 companies were measured across 29 industries.

Over 12 000 interviews were conducted with South African consumers using the Target Group Index (TGI) and Ask Afrika random digit dialing sample – about 6 000 were telephonic and 6 000 were face-to-face interviews.

The sample is randomly selected and no credit or sample lists are used. The results are independently audited by auditing firm BDO and statistical consultant and sampling specialist Dr Ariane Neethling.

"Methodological rigour is important because it ensures the robustness of the data. The response rate for the survey was above the industry norm of 75%," de Beer adds.

"If the response rate for the survey is low, the data is not representative and cannot be generalised back to the South African population. Our results are double checked for accuracy, and the entire survey takes about 12 months to conclude, which is really fast for research of this magnitude," says de Beer.

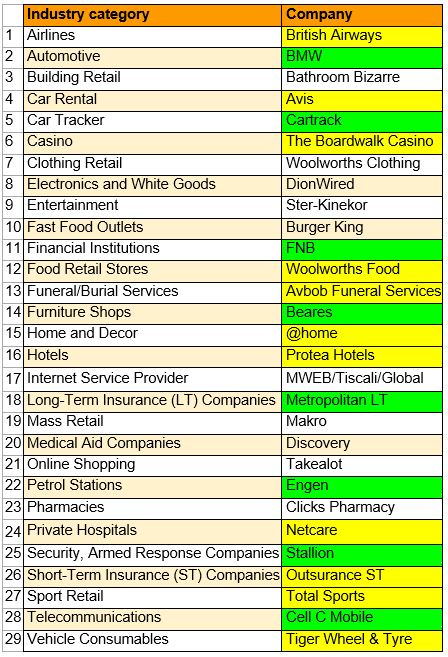

The 29 industry category winners in the 2018/19 Ask Afrika Orange Index

These companies achieved the highest service score within their industry category. New winners are highlighted in green and the super winners (having won the industry category for three consecutive years) are highlighted in yellow.

Andrea Gevers, CEO and founder of Ask Afrika, gave the opening address at the awards ceremony, which was held at The Venue in Melrose Arch on Thursday, 4 October.

"We have the third largest business process outsourcing [BPO] or call centre industry in the world, and it is 60% cheaper than the United Kingdom but more expensive than India and Pakistan," she says.

"This is due to the cost of our telecommunications, which is too expensive to allow us to compete globally. If you put this together with the rise of artificial intelligence, South Africa will lag behind if we don’t acquire knowledge," she adds.

"AI is not putting people out of jobs, as was first predicted. In fact, more people are needed to programme and operate it than the jobs it replaces, but these are educated people with knowledge," says Gevers.

Gevers says that if you have the right personality, if you are friendly, conscientious and empathetic, and have some degree of education, you can get a job in a call centre. "In the future, because of technological advancement, this will no longer be the case," she adds.

"The government protects workers, but it can’t protect jobs. In order for our service industry to remain competitive, we all need to make an effort and start investing in the industry and increasing our knowledge base," says Gevers.

The top two service drivers of 2018/19 are:

- The knowledge that employees have to resolve your queries/requests

- The professionalism of employees in dealing with you

"The service drivers this year are less complex than in the last few years, which shows that most companies are not understanding what customers want and they are not getting the basics right," says de Beer.

"Service levels have dropped by 1% year-on-year and emotional satisfaction has dropped by 10%. Even though we are better equipped to get the tactical dimensions right, such as net promoter score [NPS] and first-call resolution [FCR], we are not even doing that," de Beer adds.

"The tactical dimensions are essential but don’t differentiate service ratings. We are failing at authenticity, fairness and values, which affect the emotional experience of a customer," she says.

She adds, "Eight out of 11 core service dimensions are based on soft skills, and we need to get all the dimensions right to have a truly customer-centric industry."

For the first time this year, Ask Afrika will conduct Orange Index workshops, which take the place of reports.

These workshops will include company and industry shifts over time, ranking of companies per industry, net promoter score (NPS), customer experience (CX), customer effort score (CES), treating customers fairly (TCF), first-call resolution (FCR), emotional consistency (ESat), trust and reputation (TR), call-centre satisfaction (CCI), actionable insights and strategic recommendations.

For further information, contact

[email protected] or

[email protected].