The TransUnion study explored the credit activity of Gen Z consumers in emerging credit markets, including South Africa, Colombia and India. It also looked at established consumer credit markets including Canada, Hong Kong and the United States.

The study explored the depersonalised credit data of Gen Z consumers globally as of Q2 2019. This was to understand their credit behaviours by country — specifically observing credit activity, originations, account preferences and balances.

The percentage of the South African population that was classed as Gen Z (aged 24 and under) was 46% as of Q2 2019, representing almost 27.5 million people.

The percentage of the population that was Gen Z and over 18 — and thus eligible to apply for credit — was 10%, which is almost 6 million people. The study revealed that just over a quarter (28%) of this eligible group was credit-active in Q2 2019, which comprised almost 1.7 million people.

According to the study, this youngest credit-active generation has a strong appetite for credit, with many of these consumers growing up in difficult economic conditions. In markets such as South Africa, Canada and the United States, Gen Z saw their parents and other family members and friends suffer through recession since 2008.

In South Africa, although out of a technical recession as of Q3 2019, unemployment has remained high and the economic growth has been volatile. Other factors such as technological advancements have also come into play in the way that Gen Z manage their finances, with this generation having never known a time when mobile, online and app-based services were not available.

"Gen Z is the first generation of digital natives and they have come to expect a seamless consumer experience across all walks of life — including how they access, use and manage credit," says Carmen Williams, director of research and consulting for TransUnion South Africa.

"As young adults, they are perhaps more aware than previous generations at this age of the importance of building and maintaining healthy credit to help navigate the modern economy. As they come of age, they are starting to embrace credit opportunities to start building their financial resumes early," adds Williams.

"Our belief is that the desire for credit among this generation is significant. In order to service this demand, it's critical for lenders to have the ability to make more informed decisions on prospective customers and earn their trust as well as their business," Williams says.

Gen Z consumer credit usage

According to the study, the most commonly held products among credit active South African Gen Z consumers are clothing loans (66%). Gen Zs are eight times more likely to have this product than non-bank personal loans, the next most popular consumer credit product (8% credit activity).

The most popular credit products among Gen Z consumers include:

- Clothing — 66%

- Non-bank loan — 8%

- Bank loan — 7%

- Bank credit card — 5%

- Retail instalment — 4%

The study indicates that, for credit-active consumers in South Africa across all generations, bank personal loans are the most commonly held product (30%). By contrast, just 7% of credit active Gen Z consumers have bank personal loans.

When looking at bank credit cards, 28% of credit-active consumers in South Africa hold this product, but only 5% of credit-active Gen Z consumers do. For those Gen Z consumers who hold a credit card, their limit utilisation is higher and at an average of 68%, compared to the entire credit active population, where it is 58%.

This is likely due, according to the study, to Gen Z consumers being given lower limit amounts on credit cards. Card issuers typically assign lower limits to consumers with lower credit scores and limited borrowing history, and many Gen Z borrowers have higher risk profiles.

Although clothing loans were the most widely held product among South African Gen Z consumers, the largest total overall balances were in the auto loans category. This is by virtue of the fact that these are usually for a larger amount and longer-term than personal loans and retail accounts. They also relate to the purchase of a specific high-value item (i.e. a car or van).

In the consumption lending categories, total outstanding balances were greatest for personal loans, followed by clothing accounts and then credit cards — reflecting the combination of typical borrowing amounts and credit limits featured on these products, as well as popularity.

The TransUnion study also revealed the fastest growing product categories among credit active South African Gen Z consumers. Although building from a low base, year-on-year originations growth (the rate at which new accounts are being opened) was highest for:

- bank loans (209%)

- home loans (66%)

- retail revolving (61%)

- vehicle (52%), and

- credit cards (44%).

Risk distribution

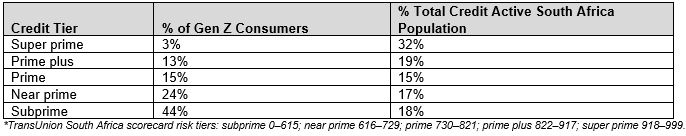

A common assumption is that all (or at least the vast majority) of Gen Z consumers are in the subprime credit tier because they don't have long histories of positive credit repayment.

The study found that this was, in part, the case in South Africa, with the majority of credit active Gen Z consumers scored as either subprime or near-prime. Compared to the overall credit active population in South Africa, Gen Z consumers are more likely to be subprime (44%) or near-prime (24%); however, there is the same percentage of prime (15%) credit-active consumers across both groups.

Risk Tiers: Gen Z vs. Total Credit Active Population

"New to credit borrowers, by definition, have little or no credit history for lenders to use to assess their risk," says Williams. "We have seen that the use of expanded data sets and advanced analytic techniques can help lenders better understand the risk profiles of these younger borrowers, and it can identify ways to engage them in a mutually profitable manner."

"Lenders that incorporate trended credit and alternative data can gain a better understanding of the specific risk profiles of Gen Z and, as a result, are broadly able to provide more consumers with access to traditional credit products," Williams says.

"Equally, as Gen Z consumers continue to build their credit history, it's important for them to get into good habits. This will help them build a healthy financial foundation and continue to be able to access the opportunities they deserve," adds Williams.

International comparisons

According to the study, there is a relatively large divide in how Gen Z approaches credit in emerging versus established credit markets. While in most established markets more than half of Gen Z are already credit active, the percentages drop precipitously for emerging markets.

The percentage of Gen Z population (aged 18+) that is credit-active with traditional credit products include:

- Canada — 63%

- Colombia —19%

- Hong Kong — 49%

- India — 6%

- South Africa —28%

- United States — 66%

*For this study, consumers are considered credit-active when they open a traditional lending product such as a credit card, auto loan, mortgage, personal loan or student loan. The emerging markets studied in the survey — South Africa, Colombia and India — have less established credit economies. In South Africa and India, credit card penetration is lower because traditional credit card issuers tend to have more conservative underwriting practices that focus on low-risk borrowers with longer credit histories.

As such, other products serve as the entry point to credit for Gen Z consumers. In South Africa, as previously stated, credit issued by retailers (a loan issued by clothing or apparel retailer) is the most widely held product at 66% — compared to just 5% for credit cards. In India, the most popular product for Gen Z consumers is a two-wheeler loan with 21% market penetration, while only 11% had a credit card.

"The ability to ensure each consumer is reliably and safely represented in the marketplace will be critical for companies that want to continue to engage the increasingly important Gen Z market segment," says Williams.

"By using advanced analytics and rich data sources, lenders can create a more informed picture of a consumer's needs, behaviours and potential risks. Those that embrace and leverage these insights will be the ones that succeed as Gen Z consumers continue to come of age and shape the consumer credit market for years to come," concludes Williams.

For more information, visit

www.solutions.transunion.com.